michigan gas tax increase history

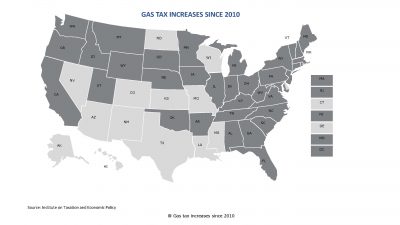

Map shows gas tax increases in effect as of March 1 2021. LANSING Gov.

Motor Fuel Taxes Urban Institute

Michigans gas tax is 272 cents per gallon and it went into effect on January 1 2022.

. Based on retail price of 2746 per gallon Michigan average for regular gasoline during 2018. For fuel purchased January 1 2017 and through December 31 2021. Gasoline Tax established at 2 cents per gallon.

The current state gas tax is 263 cents per gallon. Rick Snyder signed t he increase into law in 2015 after it passed the Republican. It will remain in place until at least the end of the year.

The legislation requires Michigans Department of Treasury to increase tax rates concomitant to inflation. WJRT -- Gas prices increased by 20 cents in a matter of hours around Mid-Michigan. Hawaii Illinois Indiana and Michigan apply their general sales taxes to gasoline and thus see ongoing changes in their overall gas tax rates based on changes.

That has pushed the Hoosier gas sales tax to 024 per gallon up 10 month over month. Gasoline 272 per gallon. Sharing 240 0025 Comp.

The increase is prescribed by a 2015 law that indexes the gas tax to the rate of inflation. Heres what MDOT says on the issue. Two years later in 1927 the rate was increased to three cents per gallon.

The chart accompanying this brief shows as of July 1 2017 the number of years that have elapsed since each states gas tax was last increased. Michigan gas tax increase history Monday April 25 2022 Edit. Each time you purchase gasoline in Michigan youre paying a couple of road-user fees as well.

Gasoline 272 per gallon. 10172019 105048 AM. 1 Among the findings of this analysis.

36 states have raised or reformed gas taxes since 2010. That makes the total gas tax nearly 075 a gallon the highest rate in state history. Thirteen states have gone two decades or more without a gas tax increase.

125 Other Taxes include a 1250 cpg Environtmental Response Surcharge gasoline and diesel Connecticut. Michiganders are also subject to a 6 state sales tax on gasoline as well as the federal gas tax at 184 cents per gallon. How is this tax calculated.

But as of Thursday. Gavin Newsoms efforts to suspend the 51-cent gas tax failed as did his idea of a 400 gas tax rebate for each registered car. This chart shows the relative size of historic gasoline tax increases in Michigan Author.

In the past week Michigan gas prices have risen to an average of 425 a gallon for regular gas. Alternative Fuel which includes LPG 263 per gallon. Getting gas can be pricy depending on the vehicle and oil market but in Michigan drivers could be forced to shell out more at the station if a.

10 states to have gone two decades or more without a gas tax increase. 1 2020 an action she said would raise more than 2 billion annually to fix. Michigan gas tax hike coming in 2022.

Other Taxes include a 14 cpg state UST fee gasoline and diesel a 225 state sales tax for gasoline a 967 state sales tax for diesel gasoline and diesel rates are rate local sales tax. 15 rows Historic Motor Fuel Tax Revenues. Gretchen Whitmer on Tuesday proposed raising Michigans gas tax by 45 cents per gallon by Oct.

Whitmer is bonding for over 35 billion to finance fixing trunkline roads which have been destroyed by. Liquefied Natural Gas LNG 0243 per gallon. For fuel purchased January 1 2022 and after.

Michigan Gas Tax 95 0190 Michigan Sales Tax 51 0102 School Aid 730 0075 Rev. That makes the total gas tax nearly 075 a gallon the highest rate in state history. 0183 per gallon.

Whitmer failed in her push for a 45-cent-per-gallon gas tax increase which the governor claimed would raise an estimated 25 billion. Michigan drivers will soon be paying more at the pump. 30 0003 General Fund 00 0000 What Makes Up the Price of a Gallon of Gas Assuming gasoline costs 200 per gallon Figure 2 of a gallon of gasoline is 200 per gallon the Michigan sales tax comprises 102 cents of that price.

Gas taxes Created Date. Thats 062 in taxes for each gallon of gas at the average. Beginning in 2022 Michigan s gas tax will increase annually according to the rate of inflation.

Federal excise tax rates on various motor fuel products are as follows. Michigans diesel fuel tax was adopted in 1947 at a rate of five cents per gallon. The 187 cents per gallon state gas tax and the 184 cents per.

The Department has set the current rate at 33. Inflation Factor Value of Increase Percentage. Nineteen states have waited a decade or more since last increasing their gas tax rates.

Diesel Fuel 272 per gallon. The tax rates for Motor Fuel LPG and Alternative Fuel are as follows. Gasoline 263 per gallon.

Drivers started Thursday morning with gas at 479 a gallon for regular. Michigan first enacted a fuel tax in 1925 at a rate of two cents per gallon. Diesel Fuel 263 per gallon.

Michigan Tax Rates Rankings Michigan Income Taxes Tax Foundation

United States Imports From Russia 2022 Data 2023 Forecast 1992 2021 Historical

Just In Time For 2021 Inflation Spike Michigan Gas Tax Getting Cost Of Living Increase Michigan Capitol Confidential

Just In Time For 2021 Inflation Spike Michigan Gas Tax Getting Cost Of Living Increase Michigan Capitol Confidential

Just In Time For 2021 Inflation Spike Michigan Gas Tax Getting Cost Of Living Increase Michigan Capitol Confidential

Road Infrastructure Asce S 2021 Infrastructure Report Card

Whitmer Vetoes Bill To Reduce Income Tax Rate

Michigan Ranked 10th In Nation For Highest Gas Tax Michigan Farm News

The Federal Gas Tax Holiday Is Not A New Idea Just A Bad One Itep

I Robot U Tax Considering The Tax Policy Implications Of Automation Mcgill Law Journal

Why Gasoline Prices Remain High Even As Crude Oil Prices Fall The Washington Post

Some Experts Call On Provincial Governments To Cut Taxes On Gas Ctv News

Just In Time For 2021 Inflation Spike Michigan Gas Tax Getting Cost Of Living Increase Michigan Capitol Confidential

Michigan Ranked 10th In Nation For Highest Gas Tax Michigan Farm News

Michigan Vehicle Registration Will Soon Go Up By 20

Just In Time For 2021 Inflation Spike Michigan Gas Tax Getting Cost Of Living Increase Michigan Capitol Confidential

How Do Income Taxes Affect The Economy Tax Foundation

The Gas Tax S Tortured History Shows How Hard It Is To Fund New Infrastructure Pbs Newshour

Michigan Ranked 10th In Nation For Highest Gas Tax Michigan Farm News